Ethereum Price Prediction 2025-2040: Technical Rebound and Institutional Adoption Fuel Long-Term Bull Case

#ETH

- Current oversold technical conditions suggest near-term rebound potential toward $4,714 resistance

- Institutional adoption accelerating through Y Combinator initiatives and $350M ETHZilla fund

- Layer 2 scaling solutions like Base receiving Vitalik Buterin endorsement improving network efficiency

ETH Price Prediction

ETH Technical Analysis: Oversold Conditions Suggest Potential Rebound

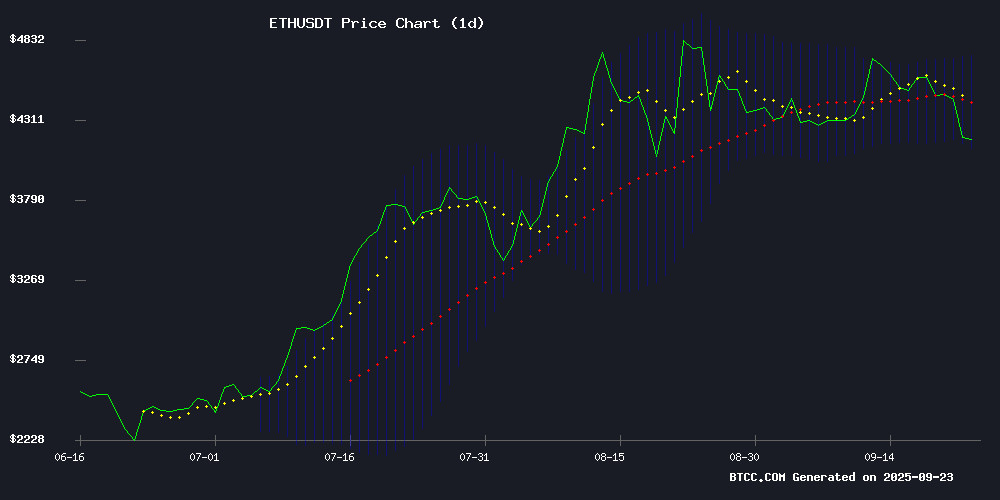

ETH is currently trading at $4,180, significantly below its 20-day moving average of $4,428.42, indicating bearish near-term momentum. The MACD reading of -62.67 shows strong downward pressure, though the histogram at -24.75 suggests momentum may be slowing. Bollinger Band positioning at the lower band of $4,125.09 reveals oversold conditions that could support a technical bounce toward the middle band at $4,428.42.

According to BTCC financial analyst Ava, 'The current technical setup shows ETH is testing key support levels. The oversold RSI combined with whale accumulation of $1 billion ETH creates a compelling case for a near-term rebound toward the $4,714 resistance level.'

Ethereum Ecosystem Developments Drive Positive Sentiment

Recent developments including Y Combinator's 'Fintech 3.0' initiative with Base partnership and ETHZilla's $350 million fundraising signal strong institutional confidence. Vitalik Buterin's endorsement of Base as the premier LAYER 2 solution reinforces Ethereum's scaling narrative.

BTCC financial analyst Ava notes, 'The combination of institutional demand surges and technological improvements like Optimum's RLNC-based efficiency boosts creates fundamental tailwinds that could override short-term technical weakness. While SharpLink Gaming's pause on ETH purchases reflects caution, the overall news FLOW remains overwhelmingly positive for medium-term price appreciation.'

Factors Influencing ETH's Price

Y Combinator Launches 'Fintech 3.0' Initiative to Fund On-Chain Startups with Base Partnership

Y Combinator has unveiled a new funding initiative targeting Web3 startups, dubbed 'Fintech 3.0,' in collaboration with Base and Coinbase Ventures. The accelerator aims to support companies building financial systems on blockchain infrastructure, citing regulatory clarity and infrastructure maturity as catalysts for growth.

The initiative positions blockchain technology as the backbone of a new financial era, enabling instant, sub-cent global payments. Y Combinator frames this as the third wave of fintech evolution, following the digitization of the 1990s and the rise of API-based services over the past decade.

Three key factors underpin the viability of on-chain finance: the GENIUS Act's stablecoin regulations, Layer-2 blockchain advancements achieving sub-second transactions, and surging market demand. Base reports nearly $15 billion in platform assets, while global crypto users now exceed 560 million.

Optimum's RLNC-Based Solution Boosts Ethereum Network Efficiency

Ethereum's validator economics stand to gain significant improvements with Optimum's new propagation layer, mumP2P. Leveraging Random Linear Network Coding (RLNC), the system has demonstrated a 5-6x speed increase in block propagation times during tests on Ethereum's Hoodi testnet. Validator giant Everstake reports average propagation times of just 150 milliseconds—a critical upgrade for large validator sets where speed directly translates to reduced missed blocks and higher staking yields.

"Faster data transfer and block signing mitigate operational risks," says Everstake CEO Bohdan Opryshko. "This means more rewards for both users and validators." While yield boosts may appear marginal at 1 basis point initially, compounded across Ethereum's staking ecosystem, the nominal gains become substantial. Blockworks Research notes that staking yields have faced steady compression since The Merge, making efficiency gains increasingly valuable.

MIT professor Muriel Médard, Optimum's co-founder, highlights the bandwidth inefficiencies of Ethereum's current Gossipsub protocol. The RLNC-powered solution addresses these limitations while laying groundwork for future upgrades like reduced slot times—a potential game-changer for Ethereum's scalability roadmap.

Ethereum Price Analysis: Whale Buys $1B ETH as RSI Oversold, Eyes $4,714 Target

Ethereum holds steady at $4,197.74 despite market turbulence, with a $1 billion whale purchase underscoring institutional confidence. Trading volume dipped 20.94% to $37.08 billion as the $4,200 level emerges as a critical battleground.

Technical indicators reveal deepening bearish momentum, with RSI and MACD readings suggesting oversold conditions. The whale's acquisition—one of the largest single transactions this quarter—signals long-term conviction amid Ethereum's sustained dominance in market capitalization.

Market participants await a decisive breakout, with the $4,714 resistance level now in focus. Such whale activity historically precedes volatility, though Ethereum's institutional adoption narrative remains intact.

SharpLink Gaming Pauses Ethereum Purchases Amid Market Volatility, SBET Stock Rises

SharpLink Gaming has temporarily halted its Ethereum buying spree, maintaining holdings of 838,152 ETH valued at $3.86 billion. The decision comes as Ethereum's price shows modest recovery, trading near $4,200.

The company continues to generate staking rewards, adding 509 ETH last week for a cumulative total of 3,749 ETH. Nasdaq-listed SBET saw a 1% premarket bump, mirroring Ethereum's slight rebound.

SharpLink's ETH concentration now stands at 3.99 despite the purchasing pause. The firm's unrealized profits remain substantial, though undisclosed in recent SEC filings.

ETHZilla Raises $350M to Expand Ethereum Investments

Ethereum treasury firm ETHZilla has secured $350 million in convertible bond financing to bolster its Ether holdings and deploy capital across the Ethereum ecosystem. The funds will target yield-generating opportunities in layer-2 protocols and tokenized real-world assets.

CEO McAndrew Rudisill outlined a strategy focused on "cash-flowing assets" that combines network growth with recurring revenue. ETHZilla has already accrued 1.5 million tokens through ecosystem participation, signaling the viability of its active DeFi approach. This move aligns with broader industry shifts toward productive asset utilization beyond passive holding.

The capital raise comes as analysts observe renewed momentum in decentralized finance, with some anticipating a potential "DeFi Summer 2.0." ETHZilla's scalable operating model and demonstrated success position it to capitalize on Ethereum's expanding utility layer.

Ethereum Bulls Eye Breakout as Institutional Demand Surges

Ethereum faces a critical juncture with resistance levels at $4,228 and $4,281 dictating its near-term trajectory. The asset currently trades at $4,181, reflecting a 2.68% dip amid cooling momentum after recent gains. Market capitalization stands firm at $505.14 billion despite the pullback.

BitMine Immersion's acquisition of 264,378 ETH signals unwavering institutional confidence. The publicly traded firm now controls 2.42 million coins—over 2% of Ethereum's circulating supply. Such accumulation underscores long-term conviction in the network's value proposition.

Technical support at $4,060 provides a safety net against deeper retracements. Analysts monitor whether whale demand can overpower overhead resistance or if consolidation becomes necessary before another upward push.

Vitalik Buterin Endorses Base as Premier Ethereum Layer 2 Solution

At Korea Blockchain Week, Ethereum co-founder Vitalik Buterin highlighted Base as a standout Layer 2 solution, blending centralized usability with Ethereum's decentralized security. He emphasized Base's compliance with L2beat's Stage 1 non-custodial standard, ensuring users retain control over their funds even in adverse scenarios.

Buterin underscored that L2beat's benchmarks go beyond technical checks, offering tangible safeguards for users. Ethereum's smart contracts act as a fail-safe, protecting assets irrespective of Base's operational status.

Rainbow Wallet to Launch Native RNBW Token in Q4 2025, Converting Points to On-Chain Assets

Rainbow, the non-custodial Ethereum wallet, announced on September 22 its plans to introduce the RNBW token by the fourth quarter of 2025. The token will convert the platform's existing points system—launched in December 2023 to reward swaps and wallet activity—into tradable on-chain assets. This strategic pivot aims to enhance user engagement and compete in the crowded wallet-token market.

The move follows Rainbow's earlier tactic of luring MetaMask users with bonus points, signaling aggressive growth ambitions. Technical upgrades, including rebuilt data pipelines, will accompany the token launch to support scaling. Distribution details remain undisclosed, but the confirmation ends months of speculation about the points program's future utility.

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and ecosystem developments, Ethereum appears positioned for significant growth through 2040. The current oversold conditions combined with accelerating institutional adoption create a strong foundation for long-term appreciation.

| Year | Conservative Forecast | Moderate Forecast | Bullish Forecast | Key Drivers |

|---|---|---|---|---|

| 2025 | $5,200 | $6,800 | $8,500 | ETF approvals, Layer 2 adoption |

| 2030 | $12,000 | $18,000 | $25,000 | Enterprise adoption, regulatory clarity |

| 2035 | $25,000 | $40,000 | $60,000 | Global settlement layer status |

| 2040 | $45,000 | $75,000 | $120,000 | Mass DeFi adoption, Web3 infrastructure |

BTCC financial analyst Ava emphasizes that 'These projections assume continued ecosystem development and mainstream adoption. The $1 billion whale accumulation at current levels provides strong validation of Ethereum's long-term value proposition.'